Use these tactics, pick the ones that fit, and act. I’ve linked directly to official resources and high-quality guides.

Banking, cash flow, and credit

- Grab any 401(k) match first – it is an instant, risk-free return. See the current limits here: IRS 401(k) contribution limits for 2025.

- Use an HSA if you have an HDHP – contributions, growth, and qualified withdrawals are tax-free. Learn mechanics in IRS Publication 969 and check 2025 HSA limits in Rev. Proc. 2024-25.

- Use a health FSA for predictable care – pretax dollars up to the annual cap. See the 2025 cap at IRS: 2025 health FSA limit.

- Set paycheck withholding accurately – keep more cash each month without a big refund later. Run the IRS Tax Withholding Estimator.

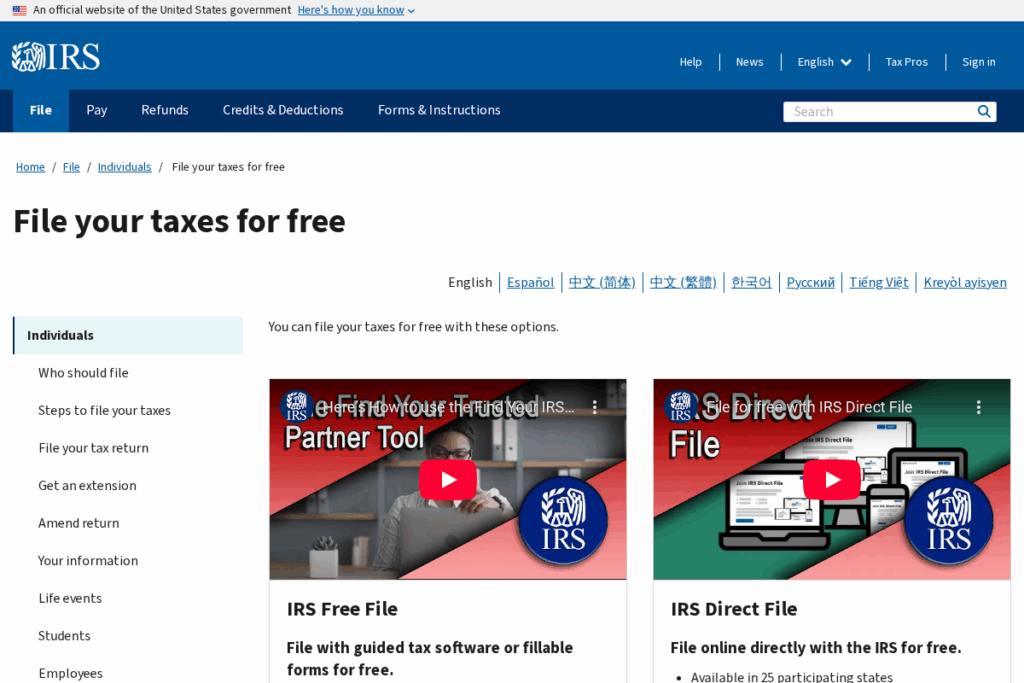

- Use Direct File or Free File – avoid paid prep when you qualify. Start with IRS Direct File and IRS Free File.

- Claim the Earned Income Tax Credit if eligible – it is refundable. Check rules and amounts at IRS: Earned Income Tax Credit.

- Claim the Saver’s Credit when you contribute to retirement – lowers tax owed. See who qualifies: IRS: Saver’s Credit overview.

- Roll old 529 money to a Roth IRA (new Secure 2.0 option) – within tight limits. See the rule note in IRS Pub. 525 (rollovers to Roth IRA).

- Get free weekly credit reports – permanently available from all three bureaus. Start at FTC: free weekly credit reports and request via AnnualCreditReport.com.

- Freeze your credit for free – block new-account fraud and cut future hassle. How-to: Security freeze basics (links to each bureau inside).

- Avoid overdraft fees – turn off overdraft, set alerts, and use low-balance notifications. Read the regulator’s guide: CFPB on overdraft fees.

- Scan for lost money – unclaimed refunds, deposits, insurance, and payroll are common. Search via USA.gov: Unclaimed money and the state network at MissingMoney.com.

Taxes and workplace benefits

- Use pre-tax transit and parking – save income and payroll tax up to the monthly caps. See 2025 limits in IRS Publication 15-B.

- Check if VITA/TCE will file your return free – trained IRS-certified volunteers. Start at File your taxes for free.

- Use employer legal benefits, EAPs, and counseling – often bundled at no extra cost; ask HR.

- Use Dependent Care FSA for child care – pretax savings can beat the credit depending on income. See details in IRS Pub. 15-B.

- Optimize student loans with IDR or PSLF if eligible – check official rules and current changes at Income-Driven Repayment and Public Service Loan Forgiveness. Track 2025 SAVE/IDR updates here: IDR court-actions page.

- File amendments when you miss credits – EITC, Saver’s Credit, or education benefits can be claimed later. Start with Form 1040-X.

Bills, telecom, and subscriptions

- Qualify for discounted phone or internet with Lifeline – monthly federal benefit. Verify eligibility at USAC: Lifeline overview and find providers via Companies Near Me tool.

- Use EveryoneOn to find low-cost plans near you – major ISPs and nonprofit offers. Try the EveryoneOn offer locator.

- Ask your utility and insurer for autopay or paperless discounts – small cuts add up; check your statements.

- Audit subscriptions quarterly – cancel in writing and screenshot confirmations. See FTC: free-trial offers and tips for avoiding “negative-option” traps.

- Use your public library’s “Library of Things” – borrow tools, instruments, hotspots, and more. Background: American Libraries: Library of Things.

- Reserve free or discounted museum passes with your library card – example: Boston Public Library museum passes and NYPL Culture Pass.

Health and prescriptions

- Use no-cost preventive care on ACA-compliant plans – annual checkups, screenings, and vaccines. See Healthcare.gov: preventive services.

- Ask for generics using the FDA’s Orange Book – confirm therapeutic equivalence. Check the FDA Orange Book.

- Price 90-day supplies through your plan’s mail-order pharmacy – fewer copays and fewer trips.

- If you get a surprise medical bill, use your rights under the No Surprises Act – dispute out-of-network charges in emergencies. Read CMS: No Surprises Act protections.

- Ask hospitals about “financial assistance” policies – many must offer charity-care or discounts. See the tax rule at IRS §501(r) hospital requirements.

- Track FSA/HSA deadlines and carryovers – avoid forfeits; confirm your plan’s rules. Reference limits: IRS Pub. 969 and IRS on 2025 FSA cap.

Home, utilities, and energy

- Apply for LIHEAP if you struggle with heating or cooling bills – federal aid via states. Start at HHS: LIHEAP.

- Get a free or low-cost weatherization audit and upgrades via DOE WAP – insulation, air-sealing, and more. See DOE: Weatherization Assistance Program.

- Claim federal home energy tax credits – insulation, heat pumps, windows, and more. See Energy Efficient Home Improvement Credit (25C) and Residential Clean Energy Credit (25D).

- Check your state’s IRA rebates as they roll out – large point-of-sale discounts for electrification and efficiency. Track status at DOE: Home Energy Rebates.

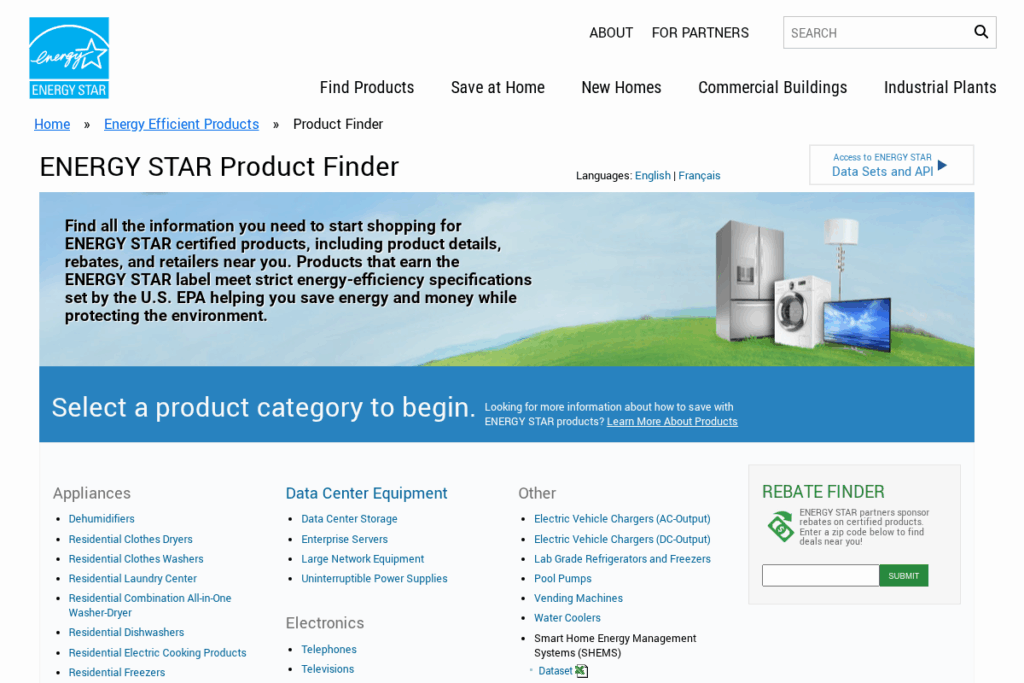

- Use the ENERGY STAR Rebate Finder before you buy appliances – stack utility and retailer offers.

- Use the EPA WaterSense Rebate Finder for toilets, showerheads, and faucets – water savings cut energy bills too.

- Get a low-cost Home Energy Score – a quick DOE assessment with prioritized fixes. Learn what it is: DOE: Home Energy Score overview.

- Follow official energy-saver steps – air-seal, right-size water-heater temperature, smart thermostats. Start with DOE: Energy Saver.

- Ask your utility about time-of-use or budget billing – shift usage and smooth costs where offered.

- Recycle an old, working fridge or freezer through utility bounty programs – often pays cash; check the ENERGY STAR finder.

- Rent or borrow tools from local “tool libraries” for DIY – avoid one-time purchases. See the Tool Library Alliance.

- Replace five most-used bulbs with ENERGY STAR LEDs – use the ENERGY STAR Product Finder to pick right models.

Food and groceries

- Double SNAP fruits and veggies in many states – match your spend at participating stores and markets. Find your state at Double Up Food Bucks.

- Use SNAP at farmers’ markets and look for match tokens – how it works here: USDA FNS: attracting SNAP customers.

- Cut food waste with correct storage times – use the USDA FoodKeeper App.

- Plan around unit pricing and store brands – cheaper per ounce on staples; verify on shelf labels.

- Batch cook and freeze in portions – fewer impulse buys; safer with FoodKeeper storage guidance.

- Join a CSA with SNAP discounts where available – ask farms; some states support it via Double Up.

- Use library cookbooks and classes to expand low-cost recipes – free and practical.

- Check community fridges and food co-ops – local options can bridge short months.

Transport and insurance

- Drive efficiently – gentle acceleration, steady speeds, combine trips. Fuel-saving math: FuelEconomy.gov: driving efficiently.

- Keep tires properly inflated – low pressure burns fuel. Quick guide at FuelEconomy.gov: maintenance.

- Use pre-tax transit or parking benefits if commuting – limits explained in IRS Pub. 15-B.

- Shop auto insurance yearly and ask about telematics discounts – neutral overview at Insurance Information Institute: saving on auto insurance.

- If eligible, use state low-cost auto programs – e.g., California Low Cost Auto and New Jersey’s SAIP Dollar-a-Day policy.

- Maintain your car on-time – oil, air filter, alignment – to avoid expensive repairs and worse MPG.

Windfalls, protections, and misc.

- Search for local appliance, thermostat, and water rebates before you buy – hit ENERGY STAR rebates and WaterSense rebates.

- Reserve free cultural passes, tools, and hotspots from your library – see what many U.S. libraries lend plus your local system’s site.

- Keep an emergency buffer in a high-yield savings account – FDIC-insured up to limits; confirm your bank’s status.

- Document everything when cancelling services – timestamps, confirmations, and bank messages reduce dispute time. See FTC advice on subscriptions.

- Revisit this list twice a year – limits and programs update annually; key pages above stay current.

Reference hub

- Federal energy rebates and credits: DOE: Home Energy Rebates • IRS 25C • IRS 25D

- Student loans and PSLF: IDR plans • PSLF • Current SAVE/IDR updates

- Tax filing and credits: IRS Direct File • IRS Free File • EITC • Saver’s Credit

- Credit reports and freezes: FTC weekly reports • AnnualCreditReport.com • How to freeze credit

- Utilities help: LIHEAP • Weatherization Assistance Program

- Telecom savings: Lifeline • EveryoneOn low-cost offers

- Food savings: Double Up Food Bucks • USDA FoodKeeper

- Auto insurance: Insurance Information Institute tips • California Low Cost Auto • New Jersey SAIP

Laws, limits, and programs change. Always confirm on the linked official pages before acting.