Living on a fixed income does not have to mean cutting the joy out of life. With a bit of planning – and by tapping into programs you may not know exist – you can spend less and live more. These 18 tips are simple to act on and include helpful links for deeper guidance.

1) Downsize or house-share – keep the memories, not the overhead

If the kids have flown the nest, a smaller place can free up cash for the things you value. Not ready to move yet? Consider vetted home sharing. The long-running NYFSC Home Sharing Program matches older hosts with compatible guests, while the nonprofit platform HomeShare Online helps people find safe, compatible housemates and reports typical savings on rent.

2) Plan meals – your list is your budget

Planning a week of simple meals and shopping with a list cuts impulse buys and food waste. If you like step-by-step guidance, SeniorLiving.org’s frugal guide explains how a basic meal plan reduces costs. Stack savings with digital grocery apps such as Ibotta, Checkout 51 and Rakuten, and look for senior discount days at your local stores.

3) Switch to generics – ask your clinician to review your meds

Generics have the same active ingredients and usually cost less. If you have Medicare, check whether you qualify for Medicare Part D Extra Help – in 2025 it caps Part D copays and eliminates deductibles for eligible enrollees. If not eligible, ask about manufacturer Patient Assistance Programs and state pharmaceutical aid listed on Medicare.gov. For routine care, community clinics can be affordable – search for a federally qualified health center near you.

4) Slash utility bills – combine habits with help

Small habits – switching off lights, LED bulbs, shorter showers – add up. For bigger savings, look into benefits: the Low-Income Home Energy Assistance Program (LIHEAP) helps with heating and cooling bills, and the Weatherization Assistance Program funds insulation and efficiency upgrades. Unsure what you qualify for? Start with BenefitsCheckUp by NCOA.

5) Automate your money – fewer late fees, more peace of mind

Automatic payments for utilities, insurance and credit cards prevent late fees and protect your credit score. Use a budgeting tool – for example, a simple budget app – to see where your money goes and to catch unused subscriptions.

6) Use community food programs – fresh and affordable

Stretch your grocery budget with programs designed for older adults. The Senior Farmers’ Market Nutrition Program offers produce vouchers, and CSFP “Senior Food Boxes” provide monthly staples. Learn about all options on USAGov’s food assistance page and find local delivery or dining-site meals through Meals on Wheels. Where available, pair SNAP with Double Up Food Bucks to double fruit and veg purchases at markets.

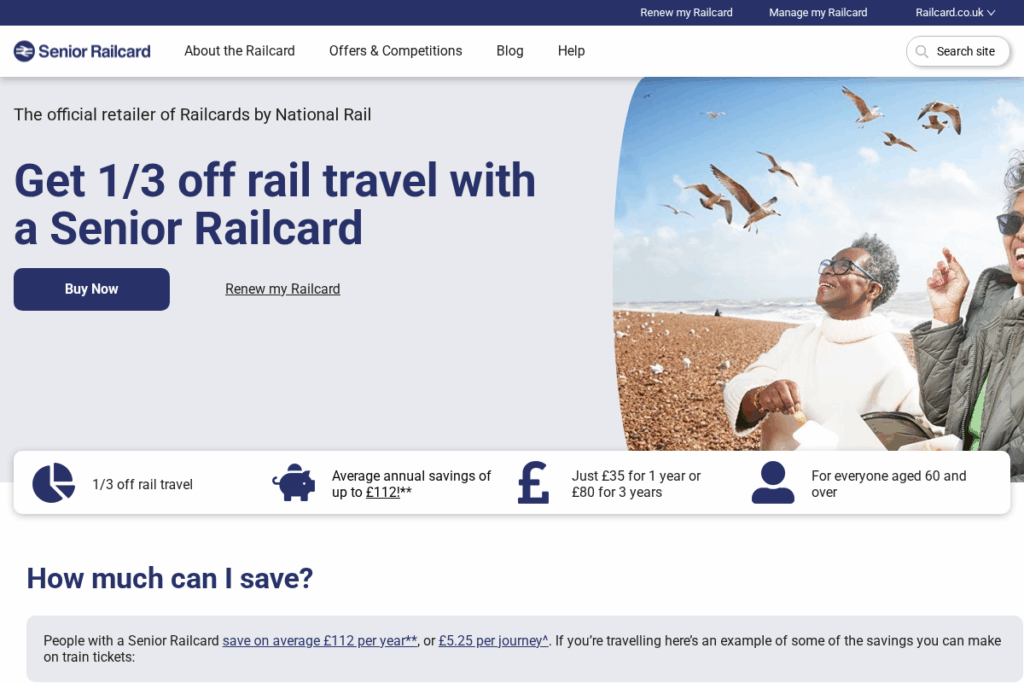

7) Travel for less – use age-based passes

Transport discounts are easy wins. In the UK, check eligibility for a free older person’s bus pass and a Senior Railcard. In the US, look for city or transit-agency senior passes and off-peak fares.

8) Try telehealth when it fits – save time and travel money

For appropriate appointments, virtual visits cut transport and time costs. An NCI-reported study estimated patient savings of about $147–$186 per visit in indirect costs. Check current coverage rules and options at Telehealth.HHS.gov.

9) Get moving – activity now reduces costs later

Regular movement supports health, independence and fewer costly complications. The CDC’s guidance for adults 50+ shows physical activity helps prevent or manage chronic conditions that drive medical spending. Choose something gentle you enjoy – walking, water aerobics, tai chi – and make it social.

10) Borrow, don’t buy – libraries of things and tool libraries

For jobs you do rarely, borrow instead of buying. Many towns now have a “Library of Things” or similar tool-lending schemes so you can borrow appliances, DIY tools or hobby gear for a small fee or membership. It saves storage space and hundreds over a year.

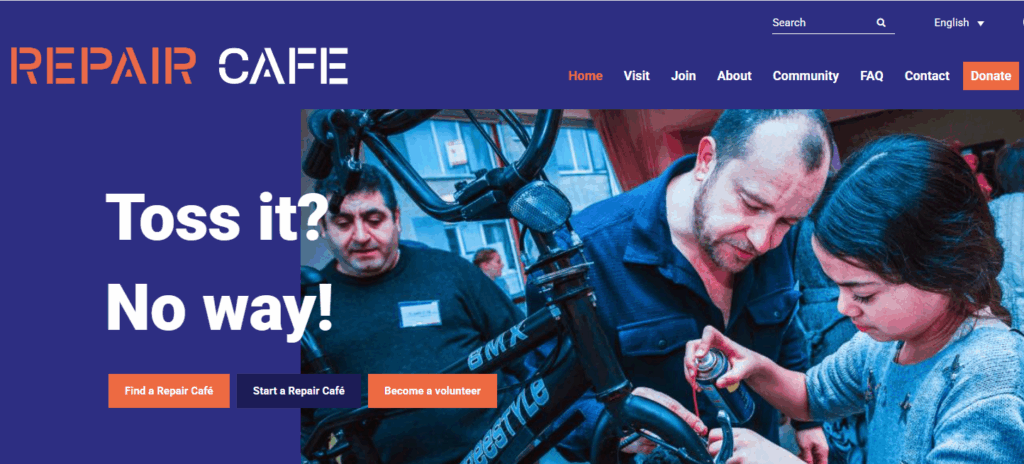

11) Repair before replacing – visit a Repair Café

Repair Cafés are community events where skilled volunteers help you fix small appliances, clothing, toys and more. Find your nearest via the international network at RepairCafe.org. Learning a simple repair can save you again and again.

12) Cut telecom costs – right-size your plan

Audit your mobile, broadband and TV bundles. Many carriers offer senior or light-use plans. Ask for a retention deal, remove unused add-ons, and consider a SIM-only plan. Price-compare annually.

13) Use senior-friendly banking – no-fee and high-yield

Switch to fee-free accounts and put emergency savings in a competitive easy-access or high-yield savings account. Automate transfers on payday so saving happens without effort. If you help family, keep shared expenses in a separate pot for clarity.

14) Audit insurance – raise deductibles, remove overlap

Once a year, re-shop home and auto insurance. Ask about safe-driver, low-mileage and home-security discounts, and check for overlap with travel or premium card benefits you already have.

15) Think second-hand first – quality for a fraction

Thrift, consignment and community marketplaces often have excellent quality household items and clothing at a fraction of retail. Focus on durable basics and classic styles. For medical equipment like walkers, ask your council, local NHS trust or senior centre about loan closets.

16) Time-bank your talents – trade skills, not cash

Join a local time bank to exchange an hour of your skills for an hour of someone else’s help. Learn how the model works at TimeBanks.org. It is budget-friendly and a great way to stay connected.

17) Use benefit checkers – do not leave money unclaimed

Millions miss out on help they qualify for. In the US, use BenefitsCheckUp to screen for food, energy and health benefits. In the UK, start with Age UK’s benefits and entitlements hub for Pension Credit, Council Tax Reduction and more.

18) Make low-cost fun a habit – free learning and local perks

Public libraries are gold – free ebooks, audiobooks, events and even tech help. Many museums and attractions offer senior days or local-resident discounts. Check your council website or your library’s events calendar and build a social routine that costs little.

Final thought – frugality should feel empowering, not limiting. Pick two tips to do this week, set one small money target, and use the links above to unlock any benefits you are entitled to.