When I was in my 20s, my financial journey was all about learning, experimenting, and holding on to the little pleasures in life. Flexibility and smart side hustles let me build a foundation that blossomed into long-term independence. You don’t have to strip all joy from your budget to get ahead. In fact, making money in your 20s can be surprisingly empowering—and sometimes pretty fun—if you take a creative approach. Whether you crave a debt-free life, are saving for a big goal, or want the freedom to set your own schedule, these practical steps will help you turn ambition into action.

1. Start with a Flexible Side Hustle

Your 20s are the perfect time to experiment with different ways of earning extra income outside your primary job or studies. Try options that suit your schedule and interests, like using money-making apps or signing up for freelance gigs on platforms such as Upwork and Fiverr. The key is choosing something that won’t burn you out—gig-based jobs or micro-tasks allow you to earn without major commitments.

Another creative avenue to consider is exploring seasonal or situational side activities for quick cash, which can sometimes develop into more steady gigs. The experience you gain from these mini-projects will boost your skills, expand your network, and, often, spark ideas for future business ventures.

2. Build Skills That Pay Off

Investing in yourself is truly the highest-yielding asset. Instead of focusing only on quick cash, spend time mastering digital skills like coding, graphic design, social media marketing, or data analysis—these abilities are in high demand and can command much higher pay as you specialize. Free and low-cost resources from sites like Coursera and Codecademy make it easy to upskill on your own schedule.

If you’re drawn to sharing your knowledge, don’t overlook the potential to get paid to teach others online. Tutoring or creating digital courses on platforms like Udemy can not only supplement your income but also diversify your professional profile—a win for both your wallet and your resume.

3. Monetize Your Hobbies and Creative Passions

You don’t need to abandon what you love to make ends meet. Many people find ways to profit from personal interests by transforming hobbies into side incomes. For example, creative types might sell custom crafts or artwork on Etsy while passionate writers can start a blog and learn how lifestyle blogs make money through ads, affiliate marketing, or sponsored content.

The secret is consistency and audience building. Use social media or platforms like Patreon to connect with like-minded folks and generate extra income while doing what you enjoy. You might be surprised by the opportunities waiting once you start sharing your passion with the world.

4. Take Advantage of the Gig Economy

If flexibility is a priority, embrace the gig economy to work on your own terms. Services like Uber, DoorDash, and TaskRabbit let you set your hours and often pay out quickly. Exploring gig work is especially useful if you have irregular commitments like classes or travel.

You can also find more specialized ideas, such as starting a simple errand business within your neighborhood or leveraging skills as a notary for local signings. Not only does gig work provide diverse income streams, but it also helps you discover what types of work suit your lifestyle before committing long-term.

5. Cultivate Smart Money Habits

Earning more is only half the equation. Building lasting wealth starts with smart budgeting and mindful spending. Use tools like NerdWallet’s round-up of the best budget apps to set spending limits and save automatically. Growing your savings early paves the way for bigger financial goals, like building an emergency fund or investing for the future.

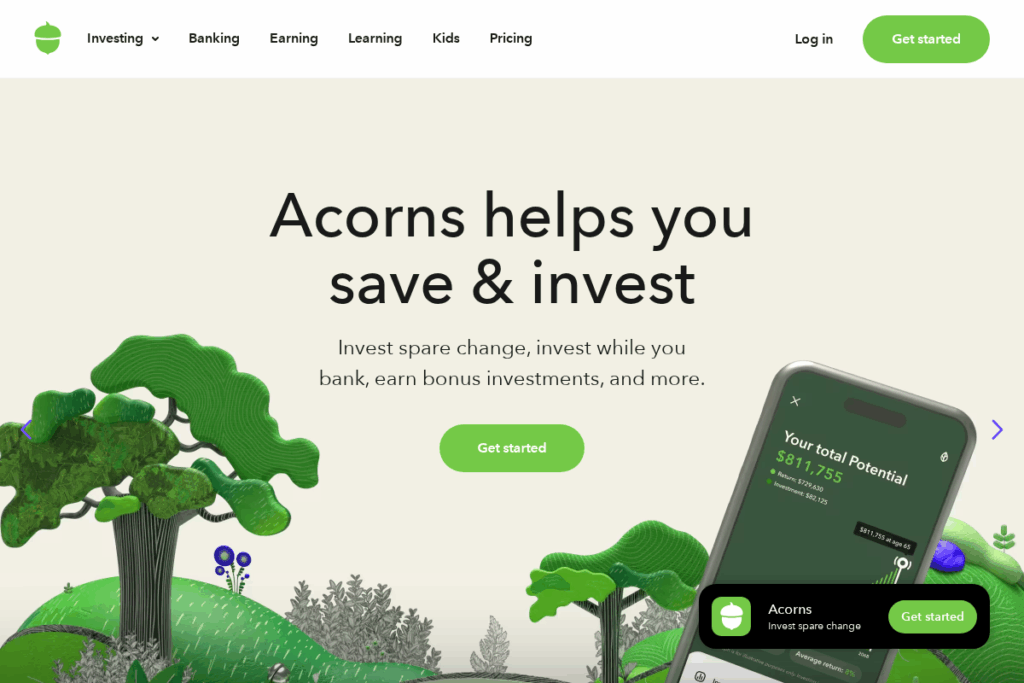

Don’t aim for perfection: balance is crucial. Automate regular deposits into savings or investment accounts, and consider micro-investing with apps like Acorns. Even small amounts add up quickly. It’s about creating consistent habits rather than chasing unrealistic saving streaks—keep enjoying the little things as you grow your wealth.

6. Invest in Long-Term Income Streams

Once you have your cash flow and savings under control, start thinking bigger. Investing is one of the surest ways to let your money work for you. For beginners, low-fee index funds or fractional-share investing with platforms like Vanguard or Robinhood make participation simple. Follow reputable guides such as CNBC’s investing basics to avoid common beginner mistakes.

Consider diversifying into digital assets or real estate when you’re ready. Even small, regular investments can lead to major gains as compounding does its work over time. This step builds the foundation for larger monthly income down the road, moving from short-term hustle to lasting financial security.

Making money in your 20s is about experimenting, learning what fits your personality, and building a toolkit of skills and habits. Every step you take brings you closer to financial independence—without forcing you to sacrifice the moments that bring you happiness. Choose flexibility, keep your options open, and let your side hustle journey shape a more abundant, free-spirited future.